The Bretton Woods institutions under geopolitical fragmentation

Introduction

The economic and military rise of China presents Western democracies with a challenge unlike any they have faced since the inception of the Bretton Woods system.1The Bretton Woods Institutions consist of the IMF and the World Bank. The World Bank is part of a network of multilateral development banks (MDBs) that, together with the IMF, form the group of international financial institutions (IFIs). In some places, the paper uses these terms as substitutes for each other. Specific examples focus mostly on the IMF, reflecting the author’s professional background. The Warsaw Pact was too weak to question the West’s economic dominance during the Cold War, but China—with its successful brand of state capitalism—has turned into a formidable competitor. It has become the largest trade partner for many countries, and the Belt and Road Initiative (BRI), despite its shortcomings, has made geopolitical inroads into the Global South that the West has struggled to match.

As the West has begun to respond to the challenge, concerns about economic fragmentation have intensified after Russia’s attack on Ukraine and increasing military tensions in the Taiwan Strait. Both China and Western countries are considering means to shore up critical supply chains and reduce strategic dependencies on each other. Global trade volumes have not yet been affected in a significant way, but a growing web of trade and investment restrictions has had a chilling effect on economic sentiment.

This dynamic also throws a shadow over the work of the International Monetary Fund (IMF) and World Bank, as well as other institutions created to support free markets and open trade. Nations that were once dependent on multilateral institutions for development funding, investment projects, and emergency aid now have the opportunity to secure economic and financial assistance from other creditors with less benign interests. Moreover, a shift toward protectionist trade policies, and the sanctioning of foreign exchange reserves by the United States and its allies, has diminished the West’s standing in many capitals around the world.

On the other hand, the US dollar’s central role in the international monetary system, of which the Bretton Woods institutions are an integral part, still provides the West with a significant advantage. The renminbi may challenge the dollar’s dominance at some point, but China’s efforts to internationalize its currency have so far been met with only modest success.

Nevertheless, the Bretton Woods institutions clearly lost influence in recent years. With many emerging markets enjoying stable market access even during the COVID-19 pandemic, the IMF and World Bank have been left to work mostly with low-income countries and a few larger countries with chronic economic problems. Many of those countries require debt restructuring to allow multilateral loans to resume, but China’s long-delayed debt workouts are effectively blocking the Bretton Woods institutions from fulfilling their mandate. Moreover, program countries question why they should subject themselves to the advice or conditionality of institutions in which they have little say, given that governance arrangements remain strongly in favor of the United States and other Group of Seven (G7) countries.

As a result, both institutions have been in search of a new role for themselves. The World Bank (along with other multilateral development banks) is looking to leverage its capital base to step up climate and development loans, and the IMF has repurposed dormant Special Drawing Rights (SDR) reserves provided by its richer members to increase its concessional loan volume, a model that could be also adopted by other multilateral lenders. Both approaches contain elements of financial engineering, reflecting tighter budgets in member countries and diminishing political support for development aid, even among traditional donor countries.

These efforts are intended to help meet large climate and development financing needs in the Global South. Moreover, multilateral institutions can be instrumental in attracting private capital to the climate fight, provided that loans fulfill their objectives and are being repaid with sufficient return. Recipient countries will, therefore, need to put any additional funding to good use, an issue that has so far attracted less attention than the intricacies of leveraging development banks’ capital base. Bretton Woods shareholders should encourage an effective division of labor among the institutions, insist on sensible loan conditionality, and, where necessary, actively support governments in meeting program targets.

However, stepped-up climate lending will not be enough to win the struggle for hearts and minds in the Global South. Given China’s current resource advantage, Western countries also need to make better use of the IMF and World Bank where doing so is in their interest. For example, to incentivize critical reforms and boost growth prospects in partner countries, multilateral financing should be flanked by co-financing, investment finance, specific trade preferences, or other forms of geopolitical support that increase the chances of program success. Unlike previous efforts, this attempt has to be meaningful and better coordinated between Western shareholders for maximum effect and burden sharing.

The example of Ukraine has set a precedent for how the institutions can be part of a strong allied effort to support a partner country within their multilateral setting. If applied more broadly, this approach could provide incentives for other governments to return to multilateral institutions, instead of China, for support. However, Western shareholders must be careful to stay within the institutions’ rules-based framework and operate on a consensual basis, where possible. The multilateral character of the IMF and World Bank is an international public good that the West would be well advised to preserve.

If and when the political climate were to turn back toward multilateral collaboration, the Bretton Woods institutions could play an important role in helping the global economy to defragment, just as they did in the years after World War II. At that point, voting shares in the institutions should be adjusted to correct the significant underrepresentation of China and other emerging markets. In the meantime, the West should identify other ways to raise the influence of the Global South, including on the two boards and in the selection of management positions.

I. China’s rise and the mulitlateral order

China rose to become the world’s second-largest economy on the back of a mercantilist economic policy that exploited Western countries’ commitment to free trade and open markets. Although a member of the World Trade Organization (WTO) since 2001, it successfully leveraged a comparative advantage in labor-intensive manufacturing through unfair trade practices to become the world’s major exporter.

While benefiting from the existing multilateral international order over several decades, China has also been turning inward for some time to replace its dependence on net exports with domestic sources of growth. Aggressive trade measures by the United States may also have prompted China to double down on domestic demand and support for domestic innovation. In 2021, China’s Communist Party embraced a strategy of “independence and self-reliance” that seeks to both establish global leadership in key technologies and secure access to the raw materials needed to reach this objective. As part of thisstrategy, China has been developing partnerships with countries in the Global South and is building up military strength, challenging US naval dominance in the Western Pacific and elsewhere.

The Belt and Road Initiative

International finance is one area where political tensions between the two camps are playing out. China has turned its BRI into a major strategic initiative to expand its presence and deepen diplomatic relations with a range of countries around the globe, predominantly in Africa. Besides generating diplomatic goodwill and deepening political relations, the initiative has helped China invest parts of its large dollar-denominated reserve holdings, estimated at up to $6 trillion, as well as promote the use of the renminbi abroad.

Although the BRI is nominally a tool to assist global development, China itself has benefited from it in major ways. It has been able to generate employment by exporting construction services to build large-scale infrastructure—including railways, highways, ports, and airports—financed by Chinese financial institutions. In many cases, this infrastructure facilitates the transport of goods destined for Chinese markets, such as oil or raw materials. Indeed, with China being a major energy importer, some analysts have seen the BRI predominantly through the lens of China’s economic and military security benefits.

From the perspective of recipient countries, the BRI has been more controversial. It has been criticized over shoddy project implementation, lack of transparency, onerous financial terms, and a growing debt burden for recipient countries. In some cases, Chinese lenders have financed prestige projects of local political leaders that had few tangible benefits, fostering corruption and debt dependence. In cases where countries encountered difficulties in repaying their loans, China has insisted on having first recourse to export revenues and was slow to restructure excessive debt burdens, which has generated considerable hardship for countries such as Angola, Ethiopia, and Zambia.

More recently, China’s state lenders have reduced their BRI loans, facing increasing pushback, but China’s commercial banks appear to have taken up the slack. China, therefore, remains a key lender for emerging markets and developing economies, rivaling the activities of the Bretton Woods institutions and multilateral development banks in the Global South.

The battle for influence in global institutions

China is using its growing economic and geopolitical clout with the Global South to actively reshape international relations in its favor. On the one hand, China has been seeking greater influence in existing multilateral institutions. While stepping up its donor engagement in the Bretton Woods institutions, it has gained more influence in the United Nations (UN), where it benefits from the “one county, one vote” principle. For example, China currently holds the leadership of four of the UN’s eighteen specialized organizations and agencies. These include agencies that would provide China with platforms to advance its own standards in several key technologies and economic sectors, potentially securing competitive advantages over Western countries. On the other hand, when facing opposition within multilateral institutions, China has sought to use multilateral or bilateral mechanisms to either bypass existing institutions or create new ones, such as the New Development Bank (NDB) or the Asian Infrastructure Investment Bank (AIIB), to increase China’s influence in developing global rules and standards.

China is not the first country to use economic leverage to gain global influence, of course. The United States, as well as the United Kingdom (UK) and France with their historical colonial ties, have followed similar strategies in the past. In principle, the governance arrangements of the Bretton Woods institutions are flexible enough to accommodate shifts in countries’ global economic and financial relevance. However, China’s approach to human rights and political and individual freedoms, and the degree of state control its one-party system exerts on the economy, are fundamentally incompatible with the liberal economic foundation that underlies the Bretton Woods institutions. This incompatibility has become a major stumbling block for governance reform, a major point of contention in the two institutions.

The “fence sitters”

In the shadow of geopolitical tensions between China, Russia, and the West, a number of larger (and mostly wealthier) emerging markets have begun to chart a more independent political course in recent years. As countries like Brazil, India, and Indonesia, along with Saudi Arabia and the Gulf states, have gained in economic weight in recent years, they also became more successful in maintaining macroeconomic stability and reducing the need for official and multilateral assistance. Despite limited room for fiscal policy, most of these countries successfully withstood the COVID crisis and a sharp rise in US interest rates that might have warranted programs with the IMF in earlier years.

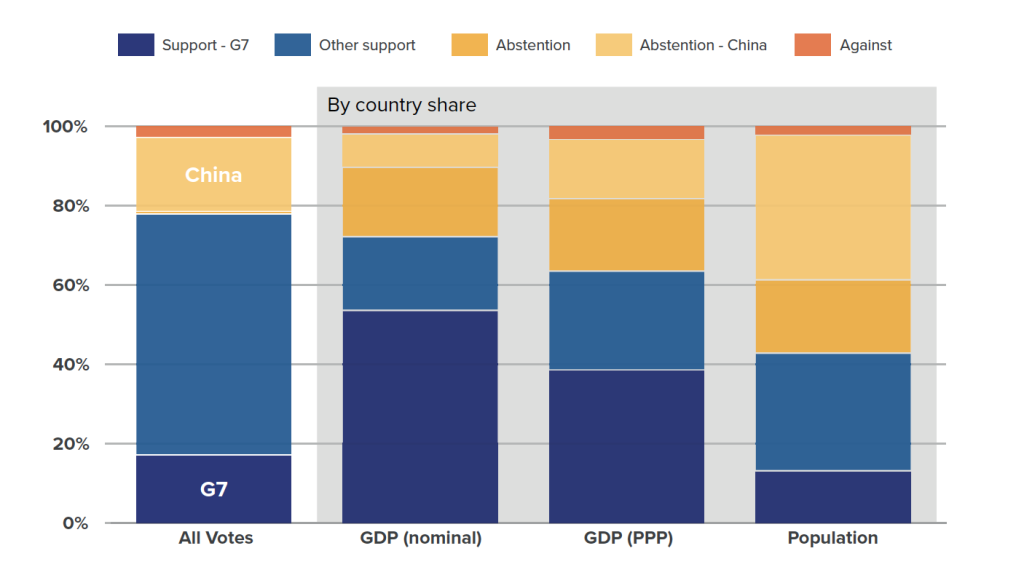

Reflecting their economic strength, as well as newfound confidence, these countries have been quietly assuming a larger role in several multilateral organizations. They have also been careful not to become entangled in the battle between major powers, instead keeping their policy options open and making decisions on a case-by-case basis. This independence become strikingly evident in the voting outcome of several UN resolutions that condemned Russia’s invasion of Ukraine in early 2022 (see chart). Although the resolutions were passed with the votes of around 80 percent of UN member countries, the majority was much smaller when measured in terms of global economic weight (between 64 and 72 percent) or world population (43 percent), owing particularly to the abstentions of India and China.

This outcome does not imply that all of these countries share autocratic tendencies or seek to curb relations with the West. Rather, the willingness to deviate from the West stems from long-standing economic and geopolitical relationships with China and Russia that countries are careful not to jeopardize, echoing the Non-Aligned Movement from Cold War days. Moreover, countries now have more room for opportunistic policies that enhance their national interests, as well as their governments’ domestic standing. Some leaders play on what Daron Acemoglu has called the “new nationalism,” building their careers on historical grievances against Western powers and the erosion of long-standing traditions and social norms as a result of globalization.

So far, the rise of these “middle powers” or “fence sitters” has played out largely within the existing UN and Bretton Woods architecture. This could be about to change, however, given the reported interest of more than forty countries in joining the BRICS (Brazil, Russia, India, China, and South Africa) bloc and its affiliated financial institution, the NDB, headquartered in Shanghai. There has also been speculation that the BRICS countries might discuss the potential establishment of a common currency to enable member countries to circumvent US sanctions in their dealings with Russia and China.

Figure 1. UN Resolution ES-11/L.5 Supporting Ukraine’s Territorial Integrity (By share in global GDP and world population)

Source: UN, IMF International Financial Statistics.

II. The slow decline of the Bretton Woods Institutions

What do these changing geopolitical circumstances imply for the Bretton Woods institutions? To answer this question, it is best to start from where the institutions stand today, less than two years after the end of the COVID pandemic.

The Bretton Woods twins’ original mandate was to help with reconstruction after World War II and to prevent a repeat of the Great Depression. The IMF, in particular, was to address economic and financial imbalances to preserve the efficient functioning of a gold-based fixed exchange-rate system, enabling the expansion of free trade and higher long-term growth. The system hardly worked as intended, however, and the United States moved the dollar off gold in 1971. Most importantly, the United States and other members were not prepared to subsume sovereign interests under the authority of international institutions, even when they had a controlling influence on their boards.

The IMF and World Bank nevertheless played an important role during the rapid phase of globalization after the collapse of communism. Acting as firefighters during major crises, their programs provided important liquidity support during the Latin American debt and peso crises, the Asian crisis, the global financial and European crises, and, more recently, the COVID crisis.

Retreat from multilateralism

The institutions have not been without controversy, of course. Opposition parties of all colors have always accused the Bretton Woods institutions of pushing for excessive austerity, and the policies of the “Washington Consensus” became synonymous with pictures of street protests and abject poverty in developing countries. Its loans still carry a stigma that countries are trying to avoid at all costs, and calls for market reforms and tight fiscal budgets are undermined by nationalism and protectionist policies moving back on the agenda in industrial countries, too. The World Bank has been subjected to criticism for the environmental consequences of its lending programs, and for not doing enough to help the fight against climate change and bring poverty down on a global scale.

Moreover, the Bretton Woods twins have long ceased to be the towering giants in their respective fields of work. Their staff is still composed of excellent economists, valued as technical advisers to central banks and governments, and their training courses and technical assistance are a global public good that remains in high demand. Nevertheless, compared to even a decade ago, hands-on macroeconomic and development expertise is now in much larger supply, including in central banks, academia, think tanks, and global financial institutions. There have also been concerns about the IMF’s repeated failure to detect and prevent the buildup of large economic imbalances, including the crises in the 1990s and 2000s, as well as the sharp increase in post-COVID inflation.

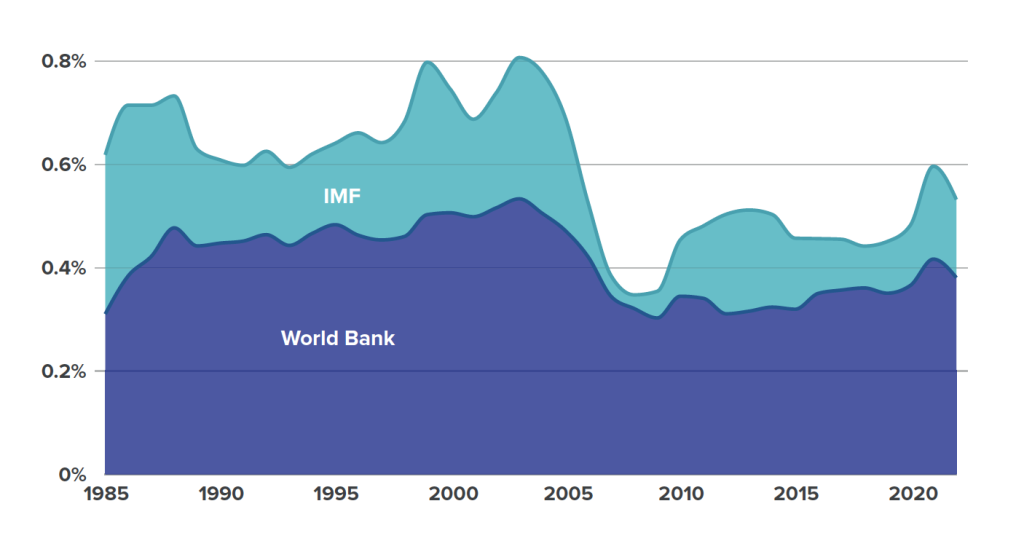

Many countries did benefit from the work of the two institutions, of course. In fact, most lending programs achieve at least a modicum of success, especially when they are based on a strong societal consensus (as in Jamaica, for example). On the other hand, because emerging markets already knew since the 1997 Asian crisis that they needed larger reserve cushions to protect themselves against capital outflows, Bretton Woods loan volumes have come down significantly in terms of gross domestic product (GDP) in recent decades (see chart).

Figure 2. World Bank and IMF lending (% world GDP)

Source: International Debt Statistics, International Financial Statistics, IMF Financial Data.

More broadly, major shareholders’ political support for multilateral institutions and their policy advice has been steadily on the decline. This has been most visible in the area of free trade, especially after the United States shut down the WTO’s Appellate Body in late 2019. As for the IMF, the task of coordinating economic and financial policies for the world economy shifted first to the Group of Seven (G7) and then to the Group of Twenty (G20). In these forums, the world’s largest economies discuss their agendas under the spotlight of a global audience that has long lost interest in the minutiae of board discussions at the Bretton Woods institutions.

Outdated governance arrangements

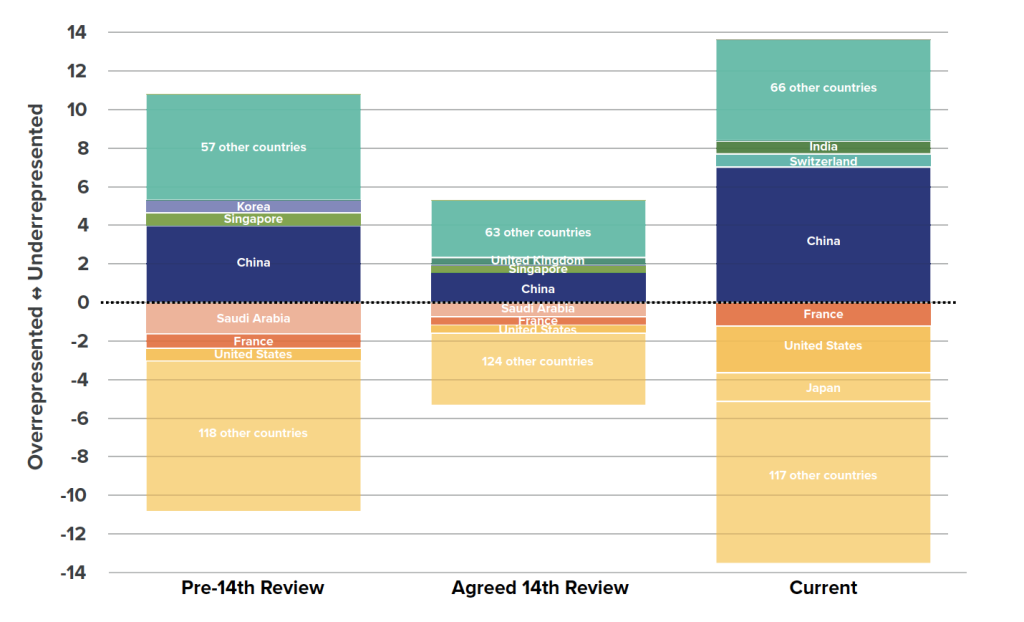

The rise of the G20 reflects, among other things, that the governance arrangements of the Bretton Woods institutions are fundamentally out of touch with economic reality. Using the IMF as an example, the last agreement to adjust capital and voting shares dates to 2010, aimed at achieving a shift of five percentage points from industrial to emerging markets. This agreement took more than five years to implement, due to a lengthy ratification process in the US Congress, and no further adjustment has taken place since.

The IMF regularly calculates how much current voting arrangements are out of line compared to a formula that has long served as a yardstick for each country’s quota, or capital share. This “calculated quota share” is a weighted average of nominal GDP (50 percent), the sum of receipts and payments in the external current account (30 percent), the variability of current account receipts and net capital flows (15 percent), and official reserve holdings (5 percent).2Further details are available in IMF Financial Operations 2018, Box 2.3. Chart X, which uses late-2020 data, and was published in March 2021, a year after the fifteenth quota review (which resulted in no change) was officially concluded. The sixteenth review is currently under way, to be concluded in late 2023.

The aggregate misalignment between actual and calculated quota shares was about fourteen percentage points in 2020, half of which were accounted for by China (Chart X). As a group, member countries of the Association of Southeast Asian Nations (ASEAN) are also undervalued, reflecting their strong growth in recent years. On the other side, many more countries are overrepresented on the IMF board, with the United States, Japan, and France, along with other European countries, accounting for around 40 percent of the overvaluation.3The World Bank has followed a different process, but similar findings apply.

Figure 3. IMF quota out-of-lineness (In percentage points)

Source: IMF Finance Department.

The difference between quota shares and their formula-derived values is only half the story, however. Historically, the prime beneficiaries of the current quota formula have been small European countries with open economies. They are benefiting from the fact that GDP only accounts for half of the calculated share, with the other half reflecting a country’s participation in international trade and reserve holdings, including intra-European Union (EU) commerce.

This discrepancy becomes evident when comparing the UK and EU countries’ combined voting share (about 30 percent) with that of the United States (17 percent)—although both economies are broadly of the same size and have a similar degree of economic openness. The large influence of Europe is further enshrined by the fact that smaller European countries have formed constituencies with countries in the European periphery that guarantee them a seat on the executive board on a fairly regular basis.

The current stasis of the quota debate can be roughly described as follows.

- First, as long as the United States remains the issuer of the world’s major reserve currency (and, thus, the main backer of the IMF’s Special Drawing Rights), it will be unlikely to give up its veto power. It would otherwise risk ceding control over at least some aspects of its money supply to the IMF, given that most borrowers use their programs to gain access to US dollars. The United States would, therefore, maintain a voting share above 15 percent.4Strategic decisions by the IMF, including quota changes or gold sales, require a majority of 85 percent of votes cast by its Board of Governors.

Second, a major block of votes would need to shift from industrial countries to emerging-market countries. This would involve a substantial decline in the share of European countries and Japan, which would be subject to enormous political obstacles. - Third, China is unlikely to agree to any outcome that will not see its voting share increase. This prospect looks remote, however, given the increase in geopolitical tensions. One formidable obstacle in this regard is the need to secure US congressional approval, but ratification would also be an uphill political battle in other countries.

- Fourth, the negotiations are complicated by the fact that many industrial countries, large and small, contribute considerable resources to various borrowing agreements and trust funds that allow the IMF and World Bank to operate as they currently do. These contributions might be politically at risk once countries have a decreasing influence over the institutions.

A related debate concerns the voice of low-income countries at the two institutions—in particular, those in Africa. At the IMF, there are currently two executive directors from the region, broadly representing French- and English-speaking countries. At the World Bank, Angola, Nigeria, and South Africa jointly hold an additional seat. However, African countries have long argued for additional seats at the two boards, which would increase their voice and reduce constituency sizes to a more manageable level.

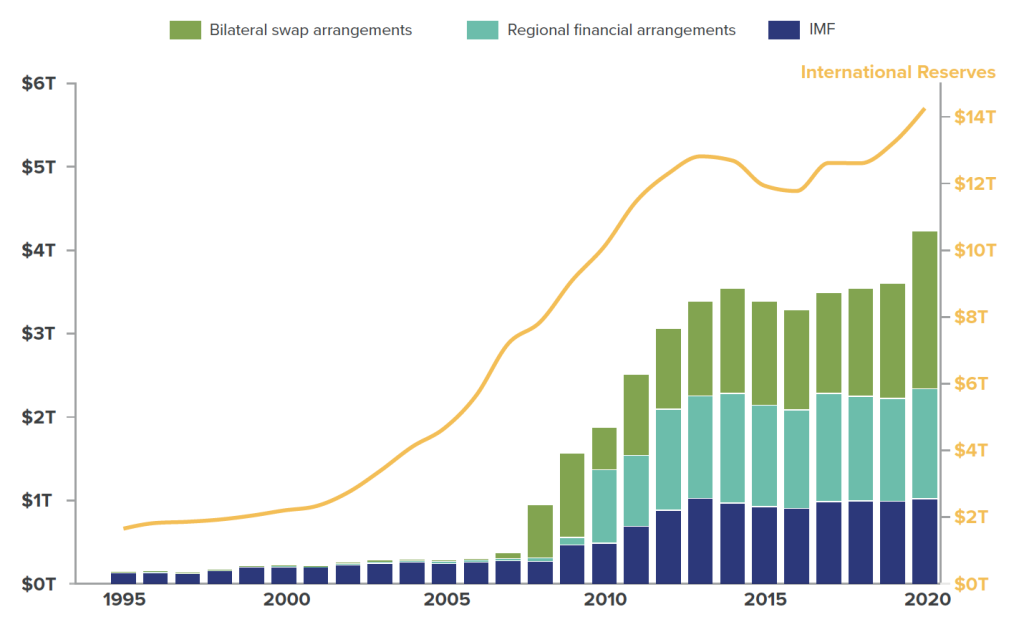

III. Benign neglect? The role of major shareholders

Debates about the governance of the Bretton Woods institutions would presumably be less intense and bitter if the institutions were seen as fully delivering on their mandate of helping member countries achieve stronger and stable growth, reduce poverty, and promote sustainable development. It is hard to deny, however, that the IMF had some key responsibilities taken out of its remit by the G20, that the World Bank has been left underfunded relative to what it has been expected to achieve, and that China has been blocking lending activities by interfering with orderly debt-restructuring processes. In that sense, major shareholders bear a key responsibility for the gradual decline of the institutions. It was in particular the 2008 global financial crisis that exposed a major shortcoming in the IMF’s role as global lender of last resort. At its core, the crisis originated in the US and European (shadow) banking systems that catalyzed unsustainable booms in the US and European periphery.5Tamim Bayoumi, Unfinished Business: The Unexplored Causes of the Financial Crisis and the Lessons Yet to be Learned (New Haven, CT: Yale University Press, 2018). As an institution lending to sovereign nations, the IMF had neither the funds nor the tools to provide liquidity injections of sufficient magnitude into the global financial system. Instead, it fell to the US Federal Reserve to keep financial institutions afloat during the crisis, both by increasing money supply in the United States and by extending swap lines to other central banks with large dollar needs. The IMF and World Bank were left to deal with the aftermath, helping countries that had neither access to the major central banks’ swap network nor the reserves to weather the shocks by themselves.

Figure 4. Financial firepower (trillions of USD)

Sources: M. Perks, Y. Rao, J. Shin, and K. Tokuoka (2021); US Federal Reserve wevsite; RFA annual reports and press releases; and IMF staff calculations.

The 2008 crisis also provided a boost to regional initiatives aimed at mitigating the impact of global shocks. Led by the European Stability Mechanism and the Chiang Mai Initiative Multilateralization (CMIM), regional financing arrangements (RFAs) have become an important part of the global financial safety net, relegating the IMF to third place in the hierarchy of global emergency financing (see chart).

This development reflects individual policy choices of large IMF shareholders. Central bank swap lines were set up to meet major central banks’ domestic policy objectives, and large members of the euro area as well as Japan, China, and South Korea were instrumental in the establishment of their regional safety nets. This was done partly for want of adequate global alternatives, and partly in response to political pressure for larger independence from the United States, which had until then been at the center of global rescue efforts. One could regard this as an early sign of geoeconomic fragmentation, caused not by geopolitical tensions but, rather, by a growing sense of regional identity in the wake of crisis seen as originating in the United States.

Weak oversight of large programs

A similar pattern could also be observed during the COVID crisis. While RFAs on the whole were not activated during the pandemic, the number of central bank swap lines increased, including on the part of the People’s Bank of China, which has increasingly become a lender of last resort in its own right. The IMF and multilateral development banks were called upon to help countries that did not have large-scale access to either source of financing.

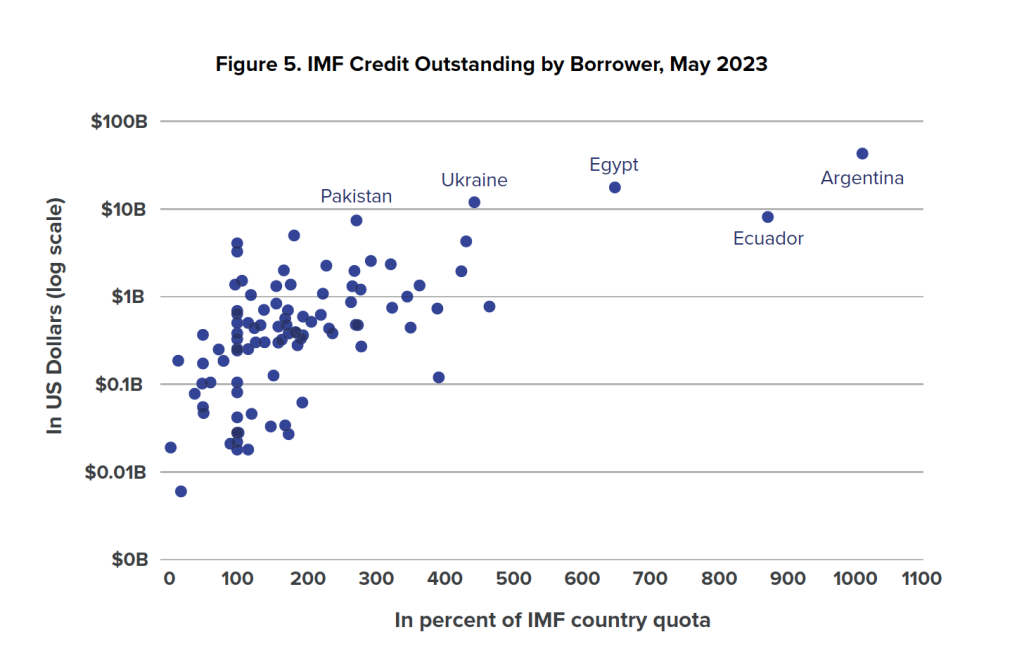

Figure 5. IMF credit outstanding by borrower, May 2023

A few of those countries benefited from the IMF’s Flexible Credit Line, receiving sizeable precautionary arrangements that involve no explicit conditionality, but most other countries had to apply for standard IMF and World Bank programs. While many of those have been successful, the lenders are also dealing with a significant number of problem loans.

Troubled programs include several emerging markets that have received fairly sizeable loans, both in absolute terms and relative to their IMF quotas, which is the common yardstick used to ensure equitable access to the IMF’s resources (see chart). These countries have repeatedly asked the IMF for support in recent years, given their lack of durable market access. IMF conditionality should, in principle, have helped countries overcome their political and structural obstacles, but this has demonstrably not been the case.

Argentina, for example, has done little to reform its economy over the years, keeping a large share of its citizens dependent on favorable commodity prices and public handouts. Egypt’s programs have similarly failed to produce the hoped-for impulse to export-led growth, not having reduced the military’s large role in the economy. Pakistan has been caught in a cycle of on-and-off programs with the IMF for decades, but the underlying fiscal and structural problems remain unchanged, with the army frequently interfering in the political process. Ecuador will likely need another IMF program as the repayments from the previous program fall due, with the political future of economic reforms much in doubt.

These developments suggest that support for the principle of “financing against reforms,” supposed to be the bedrock underlying the IMF’s lending operations, is crumbling among IMF’s shareholders. This complicates program negotiations with other countries, who would insist on evenhanded treatment; it creates financial risks for the institution; and, most importantly, it does not help the citizens of program countries who fail to see an improvement in their economic situation. Without the support of major shareholders—both inside the board room and on a bilateral level—IMF staff simply do not have the political heft to convince reluctant authorities of the need for major reforms. This is especially true where political pressures or management interests favor loan disbursements being paid out in time.

Lack of development finance

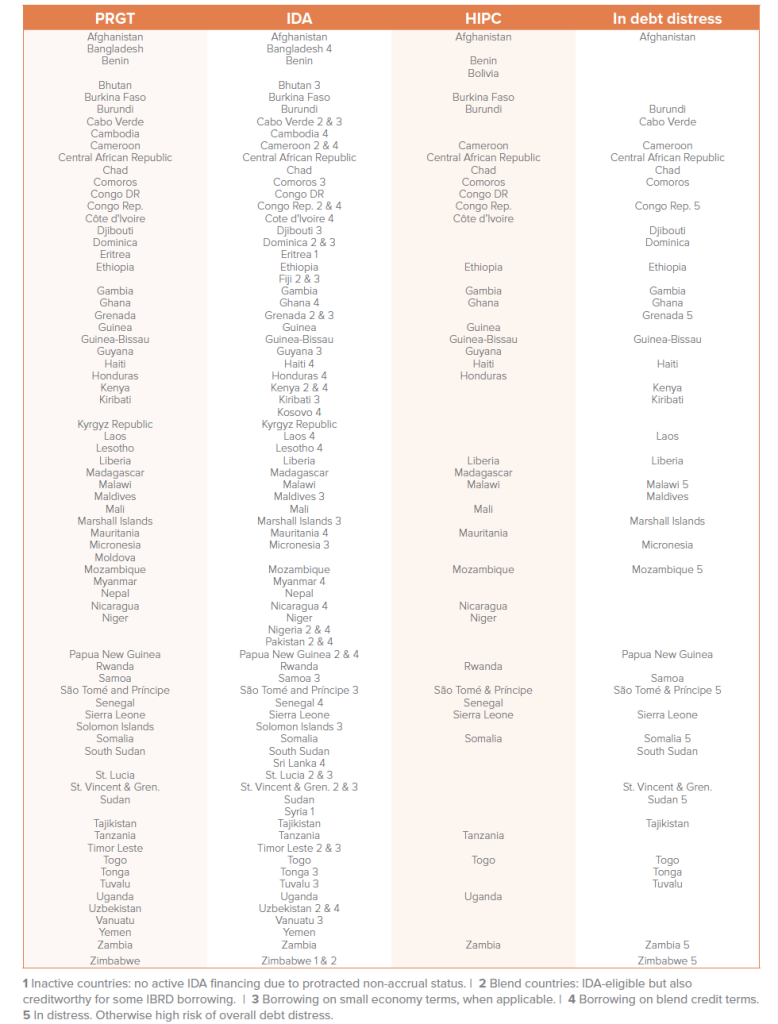

The Bretton Woods institutions appear similarly unable to help the developing world escape an endless cycle of underinvestment in human and physical capital, trade shocks, rising debt, political instability, and violence. Apart from a few countries—including Nigeria and other so-called “frontier markets”—prospects for other countries continue to look bleak. Out of thirty-nine countries now classified by the IMF and World Bank as “in debt distress” or at a “high risk of overall debt distress,” twenty had received significant debt relief through the Heavily Indebted Poor Countries (HIPC) initiative around the turn of the millennium, indicating the sustained presence of macroeconomic difficulties (see Table 1).

Table 1. LIDCs eligible for concessional Bretton Woods loans, July 2023

Source: World Bank-IMF Debt Sustainability Analyses (DSA), HIPC Initiative, IMF, International Development Association.

This outcome certainly reflects idiosyncratic problems in each country, but a lack of concessional financing has also contributed. According to the Organisation for Economic Co-operation and Development (OECD), official development assistance (ODA) in real terms reached an all-time high in 2022, but humanitarian aid and the domestic cost of absorbing growing numbers of migrants and refugees accounted for much of the increase in recent years. By contrast, bilateral ODA to low-income and developing countries fell slightly in real terms, and for sub-Saharan Africa it declined by 8 percent last year. During COVID, the Bretton Woods institutions’ emergency loans (free of explicit loan conditions) and a $650-billion SDR issuance in 2021 provided some relief, but the small amounts per country demonstrated yet again how far the poorest countries have been left behind by the rest of the world.

Finally, while multilateral institutions have long been the largest source of financing to low-income and developing countries, they are now facing three problems in stepping up their lending volumes. First, the lack of donor financing to pay for interest-rate subsidies has constrained their concessional lending capacity. Second, African countries have also become more reluctant to accept outside policy prescriptions—unsurprising in light of the example set by larger countries—which reinforces concerns about the effective use of financial assistance and hurts fundraising prospects. And third, the high indebtedness of poor countries has placed limits on the amounts of financing that multilateral institutions can provide without more fundamental debt restructuring.

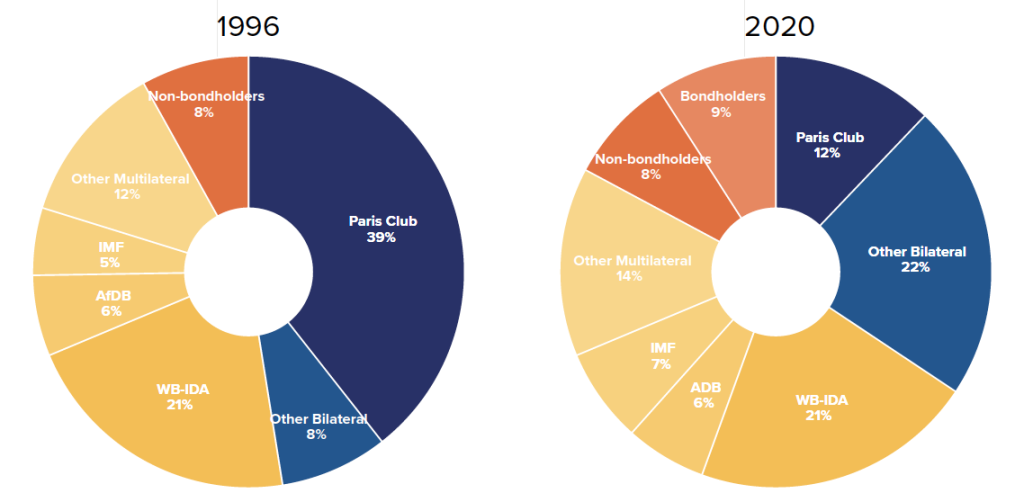

China’s block on debt workouts

The last point puts the spotlight squarely on China’s ambivalentrole as the largest official lender to developing countries. To highlight how much the sovereign debt landscape has shifted, Chart X shows that multilateral institutions and Western countries (organized in the Paris Club of official creditors) accounted for about 85 percent of all loans to low-income countries in 1996.6The chart defines low-income countries as those eligible for the IMF’s Poverty Reduction and Growth Trust (PRGT). This group is almost identical to the World Bank’s IDA recipients: there are six IDA-eligible countries (out of a total of seventy-five) that are not eligible for the PRGT (seventy in total), and one in the opposite situation (see Table X). That share had fallen to 62 percent by 2020, replaced by non-Paris Club creditors (mostly China), bondholders, and other private creditors.

These changes diminish the leverage that multilateral lenders have in promoting sound policies and good governance. First, governments now have the possibility to receive sizable bilateral loans without major policy conditions (even if Chinese lending terms overall are much less concessional and may include unrelated political conditions). Second, once China is a major official creditor, the process of debt restructuring tends to be much slower than under the Paris Club framework.

This is because, by statute, the Bretton Woods institutions are unable to lend if a country’s debt is viewed as unsustainable. Any subsequent debt restructuring used to be a well-defined process under Paris Club rules. With China and other non-Paris Club members involved, however, the process is defined by the 2020 G20 Common Framework, a much less structured exercise that is not binding on participants and leaves significant room for bilateral discussions. After the first cases took several years to move forward, the pace of restructuring may accelerate after creditors reached agreement on Zambia in June 2023. However, China still retains considerable leverage as a key creditor and trade partner to many countries. While the Common Framework may provide some reprieve, there is reason to expect further challenges to the Bretton Woods system. China and Russia already tried to increase their global influence by expanding the BRICS group, and China may step up lending though the NDB, which recently doubled its loan capacity from $50 million to $100 billion.7The IMF’s maximum lending capacity is around $1 trillion at present. The NDB could, in principle, reach a similar magnitude if its member countries were to pool some of their foreign-exchange reserve. Much of this would have to come from China, but the political diversity of the group makes this prospect unlikely. However, the seeds for a non-Western-dominated institution may already have been planted.

Even so, there is no evidence that China will be more successful in helping creditor countries achieve higher sustainable growth paths than those under the existing multilateral system. On the contrary, experience with the BRI suggests that advantages accrue mainly to China in the form of exports of construction services, access to raw materials, and deepening security and military ties, often with corrupt government elites at the expense of the broader population.

Figure 6. Creditor base for the PRGT-eligible countries: 1996 vs. 2020 (Percent of total external debt)

Source: IMF 2023.

A wake-up call

Taken together, these trends do not bode well for the future of the multilateral system. Outdated governance arrangements and underperforming programs with large politically connected member countries are not a recipe for success in a competitive geopolitical environment. Moreover, as China has begun to set up a parallel financial universe with countries in the Global South, the Bretton Woods institutions’ influence on policy decisions has been declining.

The IMF and World Bank, therefore, need to find a new modus operandi if they are to remain relevant in today’s geopolitical environment. It is possible that the G7 and the Western allies may have taken the institutions for granted for too long, deluding themselves that a hands-off approach to problems outside the advanced- and emerging-market universe could be left to technocratic institutions with little oversight. If so, the experience of the past few years should have served as a major wake-up call.

IV. Climate finance as an opportunity

The declining relevance of the Bretton Woods institutions has not gone unnoticed inside the institutions, or by civil society. Under pressure from many corners, they recognized early on that they needed to become more active in the fight against inequality, and—most of all—support global efforts to combat climate change.

The latter has now become a major focus for the institutions to redefine themselves. It starts from the observation that financing needs in the Global South are extraordinarily high. According to World Bank President Ajay Banga, trillions of dollars annually would be needed to meet climate and development goals in the developing world. As this imperative has not yet translated into major funding increases, given tight budgets everywhere, the institutions and their major shareholders are now looking for additional sources of money.

In particular, the G20 has embarked on a discussion to allow multilateral development banks to extend more loans on their existing capital base, subject to preserving high credit ratings that allow loans to be extended at concessional interest rates. Several countries have also donated parts of their SDR holdings to increase the amount of concessional loans that multilateral organizations can provide, while the World Bank is exploring ways to attract private capital to fund additional climate loans.

…But climate finance needs to be sustainable, too

Amid the newfound momentum, however, it must be kept in mind that the IMF and World Bank are financial institutions. This means that they will only be able to serve as effective facilitators, let alone catalysts for attracting private capital, if loans are being repaid and they are able to preserve their own financial standing. This aspect is often neglected in discussions of ever-growing financing envelopes, and one should guard against unrealistic expectations. Ajay Banga, the newly elected World Bank President, summed it up well by saying that it would be important to achieve “a better bank” before asking for a bigger bank.

Some activists might hope that loans could eventually be forgiven or “cancelled,” implicitly transforming official loans into climate or development grants. However, setting up recipient countries for a repeat of the HIPC experience of the late 1990s and early 2000s would be highly detrimental to their development objectives. Instead, shareholders of multilateral institutions should hold their management responsible for proper program design, while asking recipient countries to spend funds appropriately and live up to their policy commitments.

What should be the role of the Bretton Woods Institutions?

Meeting and managing the demand for climate and development finance should, in principle, play to the strengths of the Bretton Woods institutions. They should be able to intermediate additional climate funds by applying their-time tested model of cooperation.

- The project-based nature of climate finance implies that multilateral development banks should be on the frontline assisting countries in project selection, design, and implementation. Funds should be spent in a way that generates the largest possible return for the country’s citizens. This requires a realistic assessment of a country’s implementation capacity and the long-term costs and benefits of projects that could be financed.

- Using its newly developed analytical toolkits, the IMF should help countries manage the macroeconomic effects of a significant pickup in borrowing and project spending (including possible exchange-rate appreciation, wage and price pressures, or a pick-up in rent seeking and corruption). The IMF would also signal to lenders that their funds are well spent and debt remains sustainable even under new climate challenges, helping to unlock more financing. This would be mostly in the context of IMF surveillance, but traditional loans would also remain available.

Governments should have powerful incentives to ask for climate funds. For many countries, mitigating the effects of climate change is of an existential nature, which should help concentrate political support behind any measures that may be needed to qualify for additional loans. And improvements in public expenditure management, governance, or debt transparency, for example, would enhance a country’s capacity to attract private-sector capital as well, possibly kickstarting a virtuous circle that could lift growth prospects and help countries make progress toward their Sustainable Development Goals.

The IMF’s climate facility: Put it back where it belongs

As shareholders of the two institutions contemplate a way forward, however, they would be well advised to correct an earlier decision that conflicts with the optimal division of labor. The first institution to introduce an SDR-backed lending facility for climate purposes was the IMF, an institution normally not engaged in project finance. The fund crossed that line in 2022 by setting up its Resilience and Sustainability Trust (RST) to provide long-term concessional financing with a twenty-year maturity for climate purposes.8The RST is a trust fund set up to be “consistent with the purposes” of the IMF, based on a far-reaching interpretation of the 2012 Integrated Surveillance Decision that provides the fund with the authority to examine member policies outside the usual remit “to the extent that they significantly influence present or prospective balance of payments or domestic stability.” The RST gives access to 143 countries, including China and Russia, for example, but also a group of highly indebted small island economies not otherwise eligible for concessional loans. There have been ten recipients so far, with a total loan volume of about $4 billion.

Unfortunately, the setup of the RST is too complex for its own good. RST recipients are required to negotiate a regular IMF program in parallel, which is intended as a financial safeguard for donor countries. This creates an important conflict of interest. On the one hand, there are strong expectations for the RST to be quickly channeled to intended recipients. On the other hand, countries would probably not apply if they were faced with hard policy demands, given relatively modest loan amounts. Especially when tied to a moral cause such as climate reparations, this raises questions about program quality and makes it hard for lenders to halt loan tranches if borrowing countries fail to comply with the terms of a loan.

One important motivation for creating the RST at the IMF came from shareholders’ dissatisfaction with the World Bank’s climate work under its previous president. However, the bank is already heavily involved in defining the scope and conditionality of RST climate objectives, and it is now again under competent leadership. It would, therefore, be sensible to disentangle the link to full-fledged IMF programs and transfer the remaining trust fund resources to the World Bank when the facility is up for a full review in 2025. This would not change the ultimate use of those funds, but it would allow each institution to refocus on its respective strengths, eliminate a bureaucratic nightmare caused by the RST’s dual-program structure, and permit climate-specific project skills to again be concentrated in one institution for maximum synergy.

Good geopolitics, but not enough

Western countries are not only morally obliged to help the Global South advance on its climate transition; it is also a geopolitical necessity. Following the delayed provision of vaccines and other medical supplies during the pandemic, a failure for the West to provide urgently needed climate assistance could badly backfire. On the other hand, hopes for a meteoric increase in available climate funds (and their potential to quickly deliver large-scale climate victories) are likely to be disappointed. Developing countries are also likely to argue that any funds being provided reflect only a small share of the cost their countries have suffered from climate change as a result of historic carbon-dioxide (CO2) emissions.

Climate finance will, therefore, not solve the Global South’s resentment of overbearing Western countries—but not pursuing it would make things worse. The only option for multilateral development banks is to increase their funding capacity and serve as a catalyst for private investment, based on well-designed programs. Alternative means, such as raiding the capital base of the institutions, liquidating the IMF’s hidden gold reserves, creating an oversupply of SDRs, or watering down lending standards would not be sustainable, and should be firmly resisted. It would compromise the long-term ability of multilateral lenders to both help the global climate effort and fulfill other important tasks under their mandates.

V. The need for plurilateral action

The West has a strategic interest in keeping the Bretton Woods institutions strong, having invested so much financial and intellectual capital in them over the past eight decades. As the global economy is undergoing massive structural change from political, demographic, and technological factors, there is no shortage of areas to analyze, and new crises will continue to lead to requests for financial support. But if advice is not being followed and programs do not succeed, the institutions will continue to shrink in relevance, which would play into the hands of the West’s geopolitical rivals.

A first step would be to reflect on how the institutions could better fulfill their core mandate, from economic truth telling to project financing and macroeconomic adjustment programs. There is considerable room to streamline the work agenda of the institutions, which both suffer from mission creep and procedural requirements that dilute staff resources and affect output quality.

To be useful in a fragmented global environment, policy advice would have to become more pragmatic and flexible, requiring new analytical work to obtain a better understanding of the impact of industrial policies and fragmentation on individual countries and the global economy. Moreover, the two institutions could explore the role of technological and market solutions for the green transition, as well as the growth and distributional consequences of the race for critical minerals. They should also regularly remind their member countries that open markets and a level playing field remain in the long-term interest of all.

Stronger incentives for better programs

Even more important from a geopolitical perspective, Western shareholders need to help the IMF and World Bank make their lending programs work better. This will require a new approach, given the diminishing incentives for governments to heed policy prescriptions as part of their lending programs.

A major problem in programs has been that incentives to adjust are time inconsistent: there is a short-term downside from fiscal and structural reforms, but gratification from higher growth is often delayed until a program has concluded. A game-theoretic view suggests that, once a program has gotten under way, the most stable outcome is for governments to underperform and for lenders to continue to pay out nevertheless. The result can be a series of failed programs that perpetuate high debt and low growth.

To change this vicious cycle, countries require additional support measures (beyond program financing) to have a better chance at using their programs to achieve higher growth. For many low-income countries that already undergo adjustment programs, the availability of significant climate funds could play such a role, as discussed above.

When the geopolitical case for additional support may be particularly strong, the West should consider more far-reaching options. For example, to enhance a country’s growth prospects, the United States or Europe could grant countries preferential access to their domestic markets, large-scale investment financing, or enhanced access to important technologies. Other countries might ask for geopolitical support of some kind—all of which should be tied to the successful program implementation. The point is not to leave the Bretton Woods institutions alone in working with these countries, but to supplement programs with bilateral or plurilateral measures that could have a tangible economic impact.

This approach had some precedents in the euro area crisis, where the IMF played an important role in program design but was supported by the common effort of euro area member countries, involving both financing and peer pressure to move the negotiations forward. In the end, even a reluctant Greek government was convinced that staying inside the euro area was in the best interest of the country, which eventually put the Greece on a sustainable track.

More recently, this approach has been applied in Ukraine, where a G7-centered coalition provided the IMF with assurances that the country would be able to repay its loans to the institution. The program could not have proceeded otherwise because IMF conditionality, focused on economic policies, is not able to mitigate the extraordinary risks from an ongoing military conflict. With these assurances, the IMF has been able to work out a regular macroeconomic program—focused on budget implementation, inflation, and governance—even with significant uncertainty around Ukraine’s macroeconomic parameters.

The Ukraine program led to some complaints about a lack of evenhanded treatment for less connected borrowers because it was preceded by a minor change in the IMF’s lending rules.9It also took revision to the IMF’s lending into official arrears policy for an earlier Ukraine program to proceed in 2015. This is a sign that Western shareholders need to be careful to stay within the consensual character of the institutions, making it attractive for emerging markets and low-income countries to remain in the multilateral fold. In other words, to support their allies, Western countries need to pursue their geopolitical objectives in a plurilateral way that is compatible with the IMF and World Bank’s multilateral architecture.10A pluralistic approach, albeit more difficult to implement, has also been proposed for the World Trade Organization. It would be preferable to restore the WTO to full functionality, but a 2021 services agreement and other behind-the-scenes work suggests that some progress can be made.

Tying into the New Washington Consensus

Convincing governments and parliamentarians in Western capitals to step up support for countries or grant preferences of the kind just described will, of course, be difficult. However, if the West is serious about living up to the challenge posed by China, it will need to back up its determination with sufficient resources. Previous G7 initiatives, such as the Blue Dot Network or the Partnership for Global Infrastructure and Investment (PGII), have been fairly ineffective so far, and integrating the Bretton Woods institutions in this strategy will be critical.

As far as the United States is concerned, the seeds for such an approach have already been planted. In recent speeches, Treasury Secretary Janet Yellen called for a friend-shoring approach to secure key supply chains and raw materials from global partners, and National Security Advisor Jake Sullivan outlined the New Washington Consensus, a strategy to form innovative international economic partnerships by “a different brand of US diplomacy” (Box 1).

While not focusing on specific countries, these speeches made clear that the United States, in principle, is willing to extend preferences to countries in which it takes a special geostrategic interest. The EU, Japan, and other large economies should follow the US example, creating a rich pool of resources that could potentially be used to attract and support geopolitical partners.

Even if these efforts would not fully match the speed and volume of Chinese investment lending and project implementation, the West could become a more attractive partner for strategically important countries—based on more favorable lending terms, better governance, a larger push for program quality, and a genuine desire to help countries move to a higher and sustainable growth path. This could have a galvanizing impact on other countries that are accessing China for want of other alternatives. For countries held up in debt-restructuring negotiations with China, targeted support from Western countries may help them to forgo future Chinese lending, opening up an avenue to apply the IMF’s Lending into Official Arrears (LIOA) policy in selected cases.11The LIOA policy applies when countries are in arrears to official creditors and unable to obtain debt relief despite good-faith efforts. Under certain conditions, the IMF can lend in such cases, putting pressure on creditor countries to come to the table. However, countries would not be willing to default on China, often a key creditor and trade partner, unless they were able to compensate with support from the United States and other countries.

Back to the roots of multilateralism

In case of increasing geoeconomic frictions, a more systemic government response to coordinate economic and financial policies may be needed. Meeting Chinese (and Russian) challenges to the West’s liberal economic order could well exceed the capacity of existing ad hoc structures (mainly those run by G7 ministerial staff) to deliver. A broader approach to agree and implement Western policies may be needed, whether in the form of a coalition around the G7 or a Group of Twelve consisting of the United States and its leading allies in Asia, Europe, and North America. In such a case, a small intergovernmental council or secretariat could be set up to coordinate specific elements of Western policies and function as a clearinghouse for allocating common resources, collaborating closely with the staff of the Bretton Woods organizations. Such an approach would not be unique. The current multilateral system has its roots in World War I, when an Allied Maritime Transport Council began to coordinate scarce transportation capacity to both provide war material to the Western front and feed the British population.12Jamie Martin, The Meddlers: Sovereignty, Empire, and the Birth of Global Economic Governance (Cambridge, MA: Harvard University Press, 2022). The idea to overcome sovereign prerogatives through multilateral cooperation was revolutionary at the time, but it eventually led to the creation of the United Nations and the Bretton Woods system.13One of its main architects was a young French bureaucrat named Jean Monnet, who would later become instrumental in the creation of the European Union.

A century after its creation, a similar approach might again be necessary to coordinate a joint effort against powerful opponents undermining the international order.

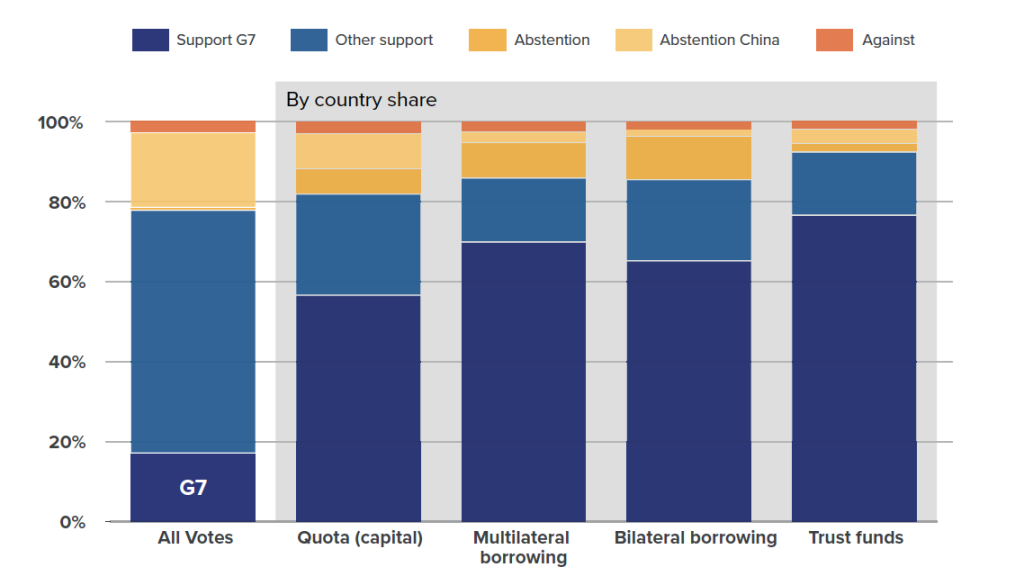

Figure 7. UN Resolution ES-11/L.5 supporting Ukraine’s territorial integrity (By financial contribution to the IMF)

Governance shortfalls need to be mitigated

Finally, the lack of adequate governance arrangements will continue to raise questions about the legitimacy of the Bretton Woods institutions. However, in light of China’s attempts to dominate other international bodies, as discussed above, it would be unwise to provide it with a significantly larger voting share as long as its policies are in clear opposition to the ideals under which the institutions were founded. The reason is that it would place China in a position to form coalitions with other countries to block strategic decisions at the two institutions.

As shown in Chart X, the group of countries not supporting last year’s UN resolutions on Ukraine would, in principle, already be able to veto key strategic decisions at the IMF. There is no indication that the UN coalition would carry over to the IMF Board of Governors, of course, but the trend is clear: the next reallocation of votes would likely give a blocking minority to countries not firmly allied with Western countries, which still provide the bulk of IMF resources.

Once China was ready to accept its obligations as a major shareholder, and in the context of reduced geopolitical tensions, discussions about serious quota adjustments will, of course, need to resume. In the meantime, should there be no completion of future quota rounds, it would still be possible to raise the IMF’s lending capacity through multilateral and bilateral borrowing arrangements, if needed. The technical work to prepare for an eventual resumption of quota discussions could, in any case, proceed.

As long as quota discussions are on hold, however, the Bretton Woods institutions should provide emerging-market countries with other avenues to increase their voice.

- The United States and Europe should agree to appoint the World Bank president and IMF managing director on the basis of merit, rather than nationality.

- The number of board chairs for emerging markets should be increased, along with the provision of a third African chair at the IMF board.

- The annual IMF-World Bank meetings could be held in an emerging-market or low-income country every other year.

Lastly, it behooves the institutions to spend more of their intellectual capital on policy questions that are of particular interest to countries in low-income and developing economies. In addition to climate policies, this includes topics such as the Integrated Policy Framework, dealing with unorthodox exchange-rate policies and capital controls, or the subject of Islamic Finance. Policy challenges outside advanced economies tend to be more difficult to understand analytically, given political, institutional, or structural idiosyncrasies, and the institutions should further expand their toolkit to serve all member countries in the best possible way.

Conclusion

This paper argues that the United States and its allies need to adopt a robust approach to marshal sufficient resources in their geoeconomic competition with China. By stepping up climate funding, as well as other financial and institutional support, to incentivize good policies in partner countries, the West can provide the Global South with a viable alternative to Chinese loans and their pernicious political influence.

Making this strategy work would require major Western shareholders to work more closely with the Bretton Woods institutions, ensuring that programs with geopolitical allies reach their intended objectives. In doing so, it will be critical to stay within the existing framework of the current multilateral system, which in itself remains a major strategic asset for the West.

Related content

About the author

Martin Mühleisen is a nonresident senior fellow at the Atlantic Council’s GeoEconomics Center and a former International Monetary Fund (IMF) official with decades-long experience in economic crisis management and financial diplomacy.

Acknowledgements

The author thanks Josh Lipsky, Charles Lichfield, Jeff Fleischer, and Tam Bayoumi, as well as participants of an informal seminar, for inspiration and insightful comments. All errors remain his own responsibility.

At the intersection of economics, finance, and foreign policy, the GeoEconomics Center is a translation hub with the goal of helping shape a better global economic future.